|

Fundamentally, there are only two

(2) objects in income tax law...

- Exempt income

"income that is ... exempt"

"income that is ... exempt"

- Taxable income

"Income that is not ... exempt"

"Income that is not ... exempt"

Ultimately, income is either

exempt or taxable

In addition, the actual tax due is only a percentage

of taxable income, not a percentage of all income.

In addition, the actual tax due is only a percentage

of taxable income, not a percentage of all income.

Data

mining income tax code will produce the following...

1. Tax imposed

"There is hereby imposed

on the taxable income of every  individual...a

tax" individual...a

tax"

- 26

USC Sec. 1

2. "taxable income"

"In general ... the

term ``taxable income'' means gross income

minus the deductions"

- 26

USC Sec. 63

“deductions”

“deductions”

|

|

|

|

|

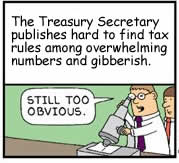

Taxes, Too Complicated?

The Supreme Court has said,

it is a "well-settled rule that the citizen

is exempt from taxation unless the same is imposed

by clear and unequivocal language, and that where

the construction of a tax law is doubtful, the

doubt is to be resolved in favor of those upon

whom the tax is sought to be laid"

- 192

U.S. 397, p-416

News commentator Paul

Harvey, on January 22, 2007, explains how

this Supreme Courst decision was put into action...

"Now for what it's

worth, the 9th circuit panel in San Francisco

has been reversed. The Internal Revenue Service,

the IRS, has ruled that Valerie and Robert McKee

owed the government $31,000 in unpaid taxes, until

Valerie and Robert demonstrated in court that

the tax law is so complex nobody can understand

it. The court had to agree that

the law was indeed so complex that nobody can

understand it, and the court reversed itself,

and the IRS gets the bill. The government also

sought and got us...ha ha ha (laugh)... your government

also tried to get a stipulation that this verdict

would not be made public, but it just was... Paul

Harvey, Good Day!!"

Case Information:

ROBERT C. MCKEE v. COMMISSIONER OF INTERNAL REVENUE

No. 04-74846

IRS No. 4036-03

-- To hear this Paul Harvey sound clip and more,

visit HearLiberty.com

|

|

|

|

|

|

3. "gross income"

3. "gross income"

"Except as otherwise provided

in this subtitle, gross income means all income from whatever

source derived"

- 26

USC Sec. 61

4. Otherwise provided

"Items of gross income, expenses,

losses, and deductions, other than those specified

in sections 861(a) and 862(a), shall be allocated or apportioned

to sources within or without the United States, under

regulations prescribed by the Secretary."

- 26

USC Sec. 863

Where's the “deductions”?

Where's the “deductions”?

Search "under

regulations" for “deductions”

(Include HTML characters and semicolon)

Sec. 861. Coincidence?

Sec. 861. Coincidence?

5. "under regulations"

"(a) Gross income means all income

from whatever source derived, unless excluded by law."

"(b) ...To the extent that another section of the Code or

of the regulations thereunder, provides specific treatment for

any item of income, such other provision shall apply notwithstanding

section 61 and the regulations thereunder."

- 26

CFR Sec. 1.61-1

So, "notwithstanding (in spite of) section 61"

(and it's claim to "all income from whatever source"),

if another section "provides specific treatment ...

such other provision shall apply".

So, "notwithstanding (in spite of) section 61"

(and it's claim to "all income from whatever source"),

if another section "provides specific treatment ...

such other provision shall apply".

6. Such other provision

Source: Government Printing Office - http://ecfr.gov

Search for:

Search for:

-

"how to determine taxable income"

- 26

CFR Sec. 1.861-8(a)(1)

- "specific sources" - Sec. 1.861-8(a)(1)

- "specific guidance" - Sec. 1.861-8(a)(1)

- "excluded income" - Sec. 1.861-8 and

1.861-8T

"deductions

to excluded income" - Sec. 1.861-8(a)(4) "deductions

to excluded income" - Sec. 1.861-8(a)(4)

- "eliminated income" - Sec. 1.861-8(d),

and 1.861-8(d)(2), and 1.861-8T(d)(2)

- "eliminated items" - Sec. 1.861-8T(d)

- "Allocation and apportionment to exempt, excluded,

or eliminated income." - Sec.

1.861-8(d)(2)

"exempt,

eliminated, or excluded income" - Sec.

1.861-8T(d)(2)(iii) "exempt,

eliminated, or excluded income" - Sec.

1.861-8T(d)(2)(iii)

- "the sources of income for purposes of the income tax" -

Sec. 1.861-1(a)

"income

that is exempt or excluded" - Sec. 1.861-8T(d)(2) "income

that is exempt or excluded" - Sec. 1.861-8T(d)(2)

- "gross income may include excluded income" -

Sec. 1.861-8(b)(1)

- "specific rules for allocation and apportionment of deductions"

- Sec. 1.861-8(a)(5)(ii)

- "expenses, losses, or other deductions" -

Sec. 1.861-8T(d)(2)(iii)

"income that is not considered tax exempt" -

Sec. 1.861-8T(d)(2)(iii) - The list of taxable items (Income

not exempt)

"income that is not considered tax exempt" -

Sec. 1.861-8T(d)(2)(iii) - The list of taxable items (Income

not exempt)

For more, see

boolean search results from regulations, and search results

from statutes - According

to law and who

is taxed.

For more, see

boolean search results from regulations, and search results

from statutes - According

to law and who

is taxed.

7. "Allocation and apportionment to exempt, excluded,

or eliminated income."

For "deductions to excluded income" the regulations

tell us to "See paragraph (d)(2)" ...

Sec. 1.861-8(d)(2)

Allocation and apportionment to exempt, excluded, or eliminated

income. [Reserved] For guidance, see Sec. 1.861-8T(d)(2).

And Sec. 861-8(d)(2) tells us to see Sec. 861-8T(d)(2)

... T is for temporary.

8. "For guidance, see Sec. 1.861-8T(d)(2)"

What is "exempt income"?

What is "exempt income"?

"income

that is ...exempt"

|

"Exempt income and exempt asset defined--(A)

In general. For purposes of this section, the term exempt

income means any income that is, in whole

or in part, exempt, excluded, or

eliminated for federal income tax purposes."

"Exempt income and exempt asset defined--(A)

In general. For purposes of this section, the term exempt

income means any income that is, in whole

or in part, exempt, excluded, or

eliminated for federal income tax purposes."

- CFR Sec. 1.861-8T(d)(2)(ii)

|

What income is not exempt? i.e.

Taxable income

What income is not exempt? i.e.

Taxable income

|

"income that is not...exempt"

|

"Income that is not considered tax

exempt. The following items are

not considered to be exempt, eliminated, or excluded income

and, thus, may have expenses, losses, or other deductions

allocated and apportioned to them:"

"Income that is not considered tax

exempt. The following items are

not considered to be exempt, eliminated, or excluded income

and, thus, may have expenses, losses, or other deductions

allocated and apportioned to them:"

- 26

CFR Sec. 1.861-8T(d)(2)(iii)

|

Sec. 1.861-8T(d)(2)(iii) lists taxable income - what

is taxed.

Sec. 1.861-8T(d)(2)(iii) lists taxable income - what

is taxed.

Supporting terms found in 861: specific sources, specific

guidance, excluded income, eliminated income, eliminated items,

& the legal definition for exempt income.

Supporting terms found in 861: specific sources, specific

guidance, excluded income, eliminated income, eliminated items,

& the legal definition for exempt income.

Notice domestic earned income has been excluded from

the list of taxable items.

Notice domestic earned income has been excluded from

the list of taxable items.

Domestic earned income is "excluded by law"

- the term doesn't even exist in the code or regulations.

Domestic earned income is "excluded by law"

- the term doesn't even exist in the code or regulations.

It

shouldn't be a surprise that something has been excluded by law.

We are told by statutes to expect this... It

shouldn't be a surprise that something has been excluded by law.

We are told by statutes to expect this...

"Except as otherwise provided"

- 26

USC Sec. 61

And by regulations...

"all income from whatever

source ... unless excluded by law."

- 26

CFR Sec. 1.61-1(a).

But, Domestic earned income is not in the list of taxable

income, because it is "excluded by law".

Fact:

Gross income "means

all income from whatever source".

Gross income "means

all income from whatever source".

But, the tax is "imposed on the taxable

income".

Taxable Income

The only item from the list of "income

that is not ... exempt" which is applicable to American citizens

is Item D, . "Foreign earned income". However, most Americans do not have any

"Foreign earned income".

Thus, according to law, most Americans do not owe federal income

tax. Their income has been "excluded by law."

Congress, Secretary, IRS, Judges, CPAs, tax lawyers, tax software

writers, ...

Explain yourselves! Ignorance of the law is no excuse. Right? We expect accuracy when we pay you to work.

If Sec. 861 is frivolous, then where is the law that you claim to

follow? Thousands of people, including your own IRS

agents, have asked you this many times, but you, and

IRS Commissioner, Mark Everson, have ignored this question.

What is the section number? ... Evidently, it is Sec. 861.

Either you know the law or you're not the experts you pretend

to be.

The

truth is tax law is so simple a child can figure it out. It shouldn't

be long before many of them do. (If teenagers can hack into NASA,

the Air Force, government computers, etc, they can easily figure

out a simple tax code.) The

truth is tax law is so simple a child can figure it out. It shouldn't

be long before many of them do. (If teenagers can hack into NASA,

the Air Force, government computers, etc, they can easily figure

out a simple tax code.)

- CNN:

Teen charged with hacking into Air Force system

- PBS:

Interview: anonymous. Young hacker caught breaking into NASA's

computers

- Zdnet:

Teen hacks 27 ISPs, gains root access

- Cooltech:

Another teen hacks NASA

The Code does not lie, but judges, politicians, and bureaucrats

do.

All of the Titles of Law are suspect of your color of law, and all

are candidates for data mining.

|