|

|

|

Videos

What does tax code really say?

Where are the “deductions”? Is there excluded

income or eliminated income? Where is the list of

taxable income?

You be the Judge. Watch these

short, five-minute videos, about searching through the U.S. tax

code and regulations with your computer. Then ask your Congressman

and Senator to watch the videos.

Ask them... Why is section 861 frivolous? |

There is

a list

|

Fact, or Frivolous?

- how to determine taxable income

- only written in the Code of Federal Regulations in Sec. 861

- income for purposes of the income tax

- only written in Sec. 861

- specific sources - only written in Sec.

861

- eliminated income - only written in Sec.

861

- eliminated items - only written in Sec.

861

- exempt income - "defined"

in Sec. 861

- excluded income - only occurs in 7 regulations

[13 times total], but is explained in Sec. 861.

- the rules for allocating “deductions”

are only written in Sec. 861. [And one of the more curious ways you

can find the rules for deductions is to search for “deductions”

at the ecfr. Include all characters,

& semicolon.]

- income that is not considered tax exempt

- [the list of taxable income] - only written in Sec. 861

- There are too many more to list here.

ATTENTION: Congressmen, Senators,

Judges, IRS, Treasury Secretary, Mr. President...

If "exempt income" is "defined" in Sec. 861, Why

is section 861 frivolous?

If "exempt income" is "defined" in Sec. 861, Why

is section 861 frivolous?

Watch these videos to see how quick and easy it is

to search through the entire tax code at the Government Printing Office

website. And notice, this same search process can be performed on every

title of law, and can be done in every country that has codification

of law. The truth, the facts, can be found - for every law.

Nothing can be hidden.

Many

more specific codes and instructions are found precisely in

Sec. 861, even "specific guidance". Many

more specific codes and instructions are found precisely in

Sec. 861, even "specific guidance".

Why does the tax code contradict what Congress

and the IRS have been telling us about income tax? They can't

all be ignorant.

Search the Code, know the law. Politicians and

bureaucrats who tax people under color of law are criminals.

And, ignorance of the law won't be accepted

during your trials. |

|  Working title, "I Am Not A Slave!"

Working title, "I Am Not A Slave!"

Starring Wesley

Snipes and Eddie

Kahn

5 Stars 5 Stars

Based on a true story, these tax martyrs are

now being punished - Snipes gets three years, and Eddie Kahn gets

ten years, for speaking facts. Among hundreds of millions

of US citizens, relatively few are brave enough to fight corruption

in government (just crooked politicians and bureaucrats),

but Wesley Snipes and Eddie Kahn couldn't resist [actually,

there are now millions* who refuse to be a part of this con. You

are aware of nothing if you still depend on Fox, NBC, ABC, CBS,

PBS, Washington Post, New York Times, etc, for information].

Snipes, stars as a man wanted by the United States

government for his role in a 'tax scam' that claims his

income is "not from a taxable source."

But apparently, Snipes has actually read and

followed the United States income tax statutes and regulations.

Perhaps, simplistic explanations from so-called 'tax experts'

were not enough information for Mr. Snipes, and he wanted to read

the law for himself.

Page two of his tax

return [TheSmokingGun.com] states that Snipes is specifically

citing sec. 861 for a refund, essentially saying that

his income is not on the list of taxable items or sources. (Imagine

that, someone who actually thought of reading the law.) He

appears to know the truth about the government's tax scam since

his claim is precisely coded as such, and he signed the return.

Could it be that Mr. Snipes, like the countless

millions who have actually read the regulations, considers the

facts more important than his own personal comforts? Though Snipes

was acquitted,

this tax martyr risked 16 years in prison to obey the truth. And,

he may still get three years in prison on the lesser charge.

Wesley Snipes appears to be a real-life action

hero. According to another such hero, former IRS agent Sherry

Jackson [*interviewed in Aaron Russo's documentary film Freedom

to Fascism, convicted - 4 years], approximately 67

million Americans don't file an income tax return. It

seems that at least a third of the available taxpaying population

have the guts to say no to these illegal government demands.

The IRS now says:

- 120 million people are expected to file.

- The IRS does not keep count of non-filers.

- Relatively few people ever face charges for not filing. (Obviously,

if 67 million don't file)

Source:

IRS spokesman, Robert Marvin

Math:

120,000,000 (expected to file)

067,000,000 (don't file)

053,000,000 (actually file?)

Could it be that less than half [120 - 67 =

53 million], or perhaps one-third of working-age Americans actually

file returns [120 + 67 = 187]?

In any case, millions of the Americans don't

file. Why?

What do all these people know that you don't?

Maybe these people have actually read their income tax rules.

These rules are available to everyone at the Government

Printing Office website. The GPO even provides a handy search

engine for you to data mine the regulations. Try searching for

"excluded income", "eliminated income", or "income

that is not considered tax exempt" [i.e. income that

is taxable]. |

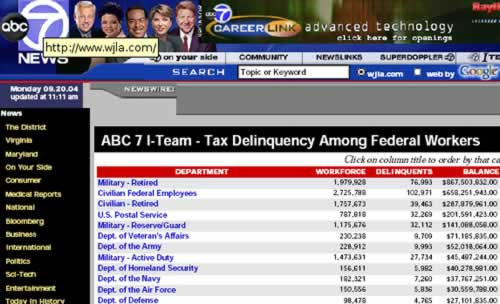

In case you think only crazy tax protesters are protesting,

take a look at this news

report showing that over 382,000 federal employees are not paying

their taxes. In total, they owe neary $2 billion.

In case you think only crazy tax protesters are protesting,

take a look at this news

report showing that over 382,000 federal employees are not paying

their taxes. In total, they owe neary $2 billion.

Notice that one of the highest tax

deliquency rates belongs to the Government Printing Office.

Evidently, because a GPO job involves publishing our tax laws, many

of the GPO employees may be actually reading them, and following them.

Apparently, only politicians are unable to follow simple

code instructions.

* Note: There are NO 'How-to-Do-Income-Tax'

packages, products, or services available at WhatisTaxed.com. Nor is

advertising bought or sold. Nothing is sold here. Items

below are only links to other websites.

|

Theft

by Deception

83 min.

5 Stars from Video.Google.com

http://Theft-by-deception.com

Plenty of graphics and details.

By Larken Rose and Dr. Tom Clayton |

| The

Spirit of 1943 - Donald Duck Pays Income Tax

5 min 48 sec.

4.5 Stars

4.5 Stars

With Disney, even a child could understand.

For a long time, the U.S. government operated

perfectly fine on the taxes it was receiving, but beginning in

1942 the politicians decided to take everyones money (what a surprise).

Notice, they used war as the reason to tax, then continued with

the tax after the war. The 'Revenue Service' began by grabbing

money before people received their wages. This is when the modern-day

slave system began in the U.S. It took a war to get this slave

system operational. The user-friendly-term for the system is called

"withholding". Originally, withholding was known as

Pay-as-you-go. |

"Payday!

Payday!"

"Every dollar you spend for something you don't

need, is a dollar spent to help the Axis."

"What are you going to do? Spend for the Axis,

or save for taxes?" |

Can't believe that your government would do these things? It's

actually much worse.

If you wish to read more, have a look at some of the

news items on The Missing Report. There

are links to many topics of abuse. For example, are you aware of what's

in your vaccines, or what happens to lab mice after they eat your genetically

modified food? Currently, corn, soy, cotton, canola, papaya, yellow

squash, and zucchini are genetically modified. For more about GM food,

see Seeds of Deception

If you prefer videos, you can watch what your government

is doing by visiting http:video.google.com,

then just search for whatever evil you can think of.

A good understanding of our government's evil deeds

can be obtained by watching some of Alex

Jones' videos. You can order his high-quality videos at his websites

infowars.com and prisonplanet.com.

You can also see Theft

by Deception on Google Video

http://video.google.com/videoplay?docid=7521758492370018023

Data-mine the Code, so that you know what you speak.

No tax advice, just digital facts. - WhatisTaxed.com

|

|

|

|

Attention Researchers

If any link has disappeared, try to copy and

paste the link address at http://www.archive.org

-- DISCLAIMER --

The intended purpose of this website, WhatisTaxed.com,

is to data mine with a computer the Internal Revenue Code, and

the Code of Federal Regulations, Title 26, for the "codes" (e.g.

taxable income, gross income, excluded income, eliminated income,

exempt income, deductions, allocation, apportionment, etc),

for rules, and instructions, for determining income tax. The

results have been published throughout this website. It should

be evident these search methods may be applied to any Title

of Law, or large volume of text, and in any country that

has codified laws and rules. See How to Search.

Nothing is for sale at WhatisTaxed.com.

Information posted at WhatisTaxed.com should not be

considered legal advice and is solely for educational purposes.

The reader should not rely on information provided herein to

determine tax.

Do not accept this

website as tax advice.

WhatisTaxed.com is only tax research from data mining tax

law.

To contribute - See How to Search, and Contact

Us.

We do not sell, promote, or advise anything,

but data-mining, searching, and reading tax code with the only

appropriate code tool ... your computer.

We do find every occurrence of a particular

code-term to establish precisely what is written, and what is

not written in tax law. When we say, no other rule

or statute exists - for example, regarding excluded

income, we show you how many files contain this important

code term, and how we searched for it with a computer. You can

easily verify any of the laws, rules, or code-terms in question,

and you should verify every result because it is your duty

to know and follow the law. Ignorance is no excuse.

You are

responsible for doing your taxes.

Questions: If you have questions, try asking

your Congressperson or Senator.

Ask your lawmaker to explain these Sec. 861 search

results ...

Ask your lawmaker to explain these Sec. 861 search

results ...

- "eliminated income" - Sec. 1.861-8(d), 1.861-8(d)(2),

1.861-8T(d)(2)

- "excluded and eliminated items of income" - Sec.

1.861-8T(d)

- "eliminated items" - Sec. 1.861-8T(d)

- "excluded income" - Sec. 1.861-8 and 1.861-8T

- "income that is exempt or excluded" - Sec. 1.861-8T(d)(2)

- "specific sources" - Sec. 1.861-8(a)(1)

- "specific guidance" - Sec. 1.861-8(a)(1)

- "how to determine taxable income" - Sec. 1.861-8(a)(1)

- "the rules [of Sec. 1.861-8 ...] for determining

taxable income" - Sec. 1.863-1(c)

- "Exempt income ... defined" - Sec. 1.861-8T(d)(2)(ii)

- "income that is not considered tax exempt" [i.e.

taxable income] - Sec. 1.861-8T(d)(2)(iii)

Source: http://ecfr.gov

Ask your Congressman and Senator ...

If "Exempt income" is "defined"

in Sec. 861, why is Sec. 861 frivolous?

If "Exempt income" is "defined"

in Sec. 861, why is Sec. 861 frivolous?

Find your Congressperson: http://www.house.gov

Find your Senator: http://www.senate.gov

Answers: If you want answers, you can try

asking the press - the American

media and foreign

media.

The Code of Federal Regulations

When searching tax law, we pay close attention

to 26 CFR...

"the Official Interpretation"

"Federal Income Tax Regulations

(Regs) are the official Treasury Department interpretation of

the Internal Revenue Code"

- Internal

Revenue Manual, 4.10.7.2.3.1

"Federal Tax Regulations pick

up where the Internal Revunue Code (IRC) leaves off by providing

the official interpretation of the IRC"

- http://www.irs.gov/taxpros/article/0,,id=98137,00.html

The Code of Federal Regulations are the rules, written

in plain English, which both the public and the IRS must follow:

"The Service is bound by the

regulations."

- Internal

Revenue Manual, 4.10.7.2.3.4

Since "the Service is bound," we can be sure that

we are playing by the same rules. It does not require a law

degree to understand them. See How to Search and Search Examples.

|

|